Nothing is sure in this life. Now you’re okay, the next day, who knows. Health Insurance helps you get protected from the possible unpredictable eventualities life can bring.

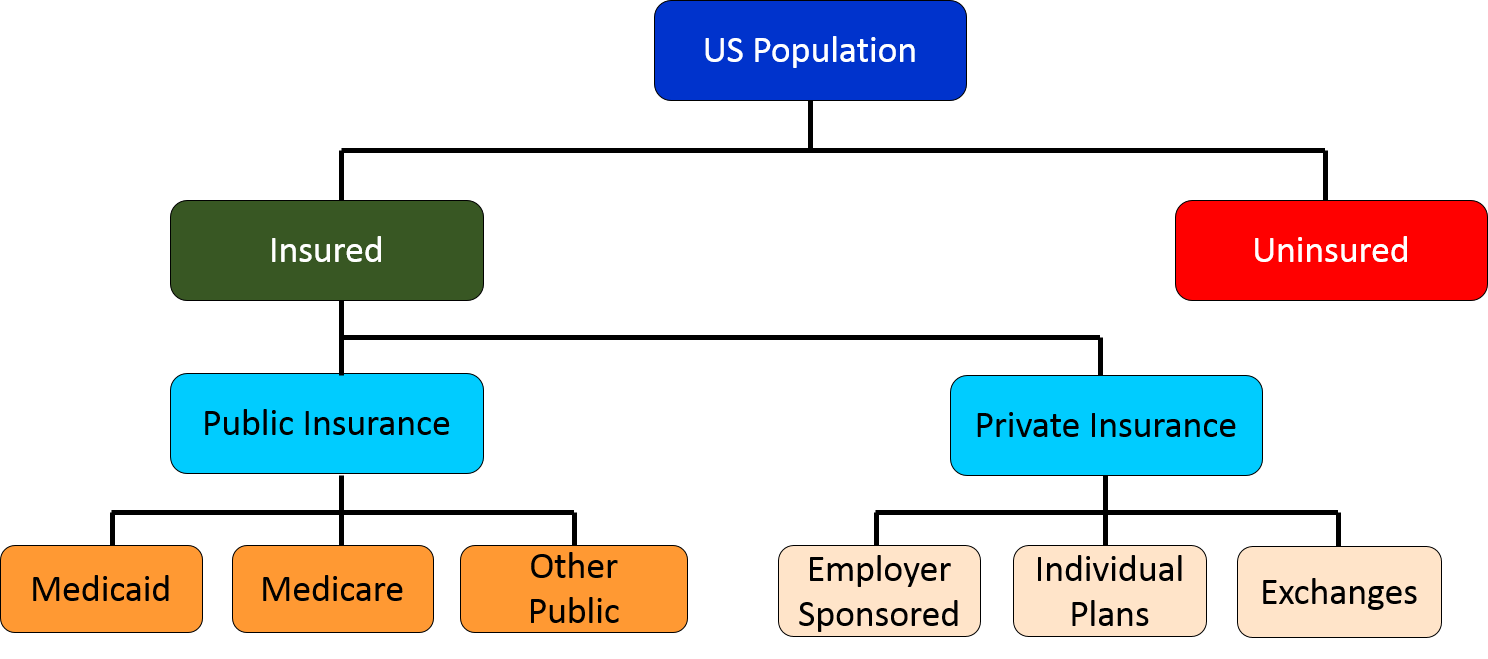

Public Vs. Private Health Insurance

There several reasons to get health insurance, and it’s very important not only to you but to your family. It’s imperative that you understand the type of health insurance that you will choose. Carefully study the rules and policies, the cost, and the benefits. If you are considering a private or a public health insurance, here are some pros and cons that could help you decide.

Private insurance

Pros:

- Has more benefits than public insurance.

- You get peace of mind should health problems require you to be treated in a private system.

- Avoid Medicare levy surcharge.

- No need to worry about the long public hospital waiting list.

- Dental health coverage.

- You can select your own doctor or surgeon.

- There is a private health insurance rebate.

- Saves you money long term on Lifetime Health Cover.

- Improved and well-maintained facilities.

Cons:

- It costs higher than public health insurance.

- You have to be prepared for other out-of-pocket costs. There are insurance companies that cover only 80% of the total cost of care.

- Private health insurance does not cover all conditions.

- They give priority to those who have the money to pay.

Public Insurance

Pros

- It is more affordable. Even the low-income people and families can afford it.

- Though the cost of insurance may be a little lower, it still provides you with an increasing list of benefits.

- Allows you to have a combination of Medicare plans to achieve a more comprehensive plan.

- You can be entitled to get help with other out-of-pocket expenses.

- Everybody is treated the same, whether you have the money or not. Those with severe conditions generally receive the treatment first.

Cons:

- You can’t apply for public health insurance if you don’t meet the requirements for eligibility.

- Some doctors are not willing to accept patients with public health insurance. The payout per treatment is lower than the private insurance, and there’s a lot of paperwork required.

- The facilities are not enough to cater to everyone’s needs. They can be overcrowded and may lack amenities.

Things to Consider When Choosing

Study well the pros and cons of public and private health insurance. Analyze each coverage offered to you very well by the considering the following:

Cost

When considering your budget, you must know how much the premium and deductibles are, among other factors. Inquire if there’s a limit on what you could pay out-of-pocket for medical services in a year.

Coverage

Does the plan cover the services you need?

Other coverage

Make sure you understand how things work if you have additional health coverages.

Prescription drugs

Find out if your prescription drugs are covered, or if you still need to have a separate prescription drug plan. Know the rules regarding your prescriptions.

Doctor and hospital choice

Can you choose your preferred doctor or hospital? Are your preferred doctors or facilities accepting new patients?

Quality of care

The quality of care and services varies with each provider. Compare and see which suits you.

Travel

Take into account if the insurance covers you even when you are in another state or outside of the US.Remember, there is no one-size-fits-all health insurance, so you have to choose wisely as to which one suits your needs. Whether you want a private or public health insurance, it is up to you. Both types of insurance have their own pros and cons. Whatever you choose, the important thing is you get insurance that will provide you with protection and will cover your medical expenses whenever you need it.

It’s very important to ask the agent or whoever is in-charge whenever there are things that are not clear to you before you sign up.