Congress passed and made the Mental Health Parity and Addiction Equity Act (MHPAEA) a law some ten years ago. With its passing was the rising hope that individuals who suffered from mental health maladies and substance abuse could get treatments as quickly as those who have other conditions.

But almost a decade later, that hope has clipped wings.

“Financial wellness is a component of overall wellness,” according to Joe Lowrance, PsyD.

The Issues

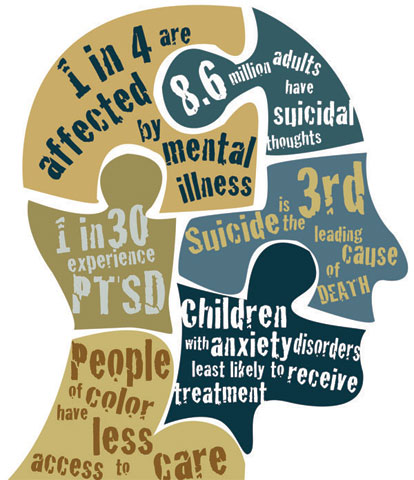

Many people who have mental health conditions have difficulty finding therapists who accept insurance. Additionally, looking for treatment facilities for PTSD and bipolar disorder that’ll take insurance for inpatient therapy can be very challenging.

Why is that?

The answer lies in how insurance companies are treating mental conditions and substance abuse as well as the treatments appertaining to these said health circumstances.

Milliman, a healthcare consulting firm, found two significant inequalities in the way the insurance market treats addiction and mental health compared to their physical counterpart.

Source: tampatherapy.com

Stacy Notaras Murphy, LPC said “Finances just might be the great equalizer in the counseling room.”

The Disparities

In their analysis of about 42 million medical claims records from various major insurance players, they discovered that:

- Firstly, four to six of ten Americans have to employ out-of-network mental healthcare, and the most likely cause is that a lesser number of psychologists and psychiatrists accept insurances.

- Secondly, for therapists who are in in-network psychological health care, the reimbursements they receive from insurers are significantly less than what primary or specialty care providers get for similar treatments. Example, in 2015, primary medical professionals collected approximately 20% more than mental health professionals did from insurance companies meaning that for every $1 the former got, the latter only had 83 cents.

This common insurance company practice has created an imbalanced system for both mental and physical healthcare and could become the chief reason why psychological therapists wouldn’t accept insurance in the future. And it’s happening as the country is grappling with the rising number of deaths through suicides and overdoses. In fact, the current rates for these two are at their highest in over ten years!

Put Teeth To the Law

2008 saw the passing of a landmark mental parity law. Its goal was to make psychiatric health care and abuse treatments more accessible to people by preventing insurers from erecting blockades to therapy services, something they wouldn’t usually do for physical medical care.

For instance, the law prohibits insurance companies from determining payment caps for addiction and depression treatments, restraints that wouldn’t otherwise be present if the said ministrations were for physical maladies such as an injured foot.

In theory, the law would make broader insurance coverages for mental disorders and addictions while lessening the barriers people seeking psychiatric care might encounter.

But it seems all of that would have to stay on paper.

“I am quite surprised it was this bad,” said a health services company’s former CEO who has worked on parity for a decade now. “I thought we were doing better, but these numbers just proved that insurance companies are still giving mental health little regard after all these years, even after the passing of that landmark law.”

And The Hurting Shows

Caryl suffers from borderline personality disorder while wrestling addiction issues at the same time. She sees a therapist for both conditions weekly. Before, she had a co-payment of $25 for every session she has with the said professional. But in 2015, however, the latter refused to accept her insurance which upped her therapy payments to $110 for every session.

She called ten other therapists asking them if they’re willing to take insurance from new patients and all flatly said no.

“I make $30,000 annually, so those $110 therapy sessions are like luxury items to me. There were weeks I had to choose groceries over visits to my therapist and for someone (like me) who are struggling with jobs, making friends and living, that’s just so wrong,” she lamented. “It feels like I’m not worthy enough to be helped.”

As what one mental health advocate stressed out: “Two of the main reasons why people don’t seek mental health treatments is the scarcity of the providers and the cost for each session. And this reality is hurting a great number of Americans.”

According to Brad Klontz, PsyD, CFP, “If you’d like help managing financial stress and your family’s financial behaviors, consider talking to an expert.”